CoVid-19 and the rise of platform ecosystems in healthcare

Sangeet Paul Choudary

BigTech platform moves into healthcare have been accelerated by the Covid-19 pandemic. While most of these platforms created new digital tools and infrastructures in response to the pandemic, they also made further inroads into the industry launching new consumer services (such as Amazon’s Amazon Halo and Halo Band) and enterprise infrastructure (such as Google’s Cloud Healthcare API). The pandemic has also accelerated shifts in consumer demand – consider how the demand for remote healthcare has created new opportunities for such platform firms. (For instance, Epic Systems had less than 50,000 appointments on its telehealth services in February 2020, but 2.5 million by April.)

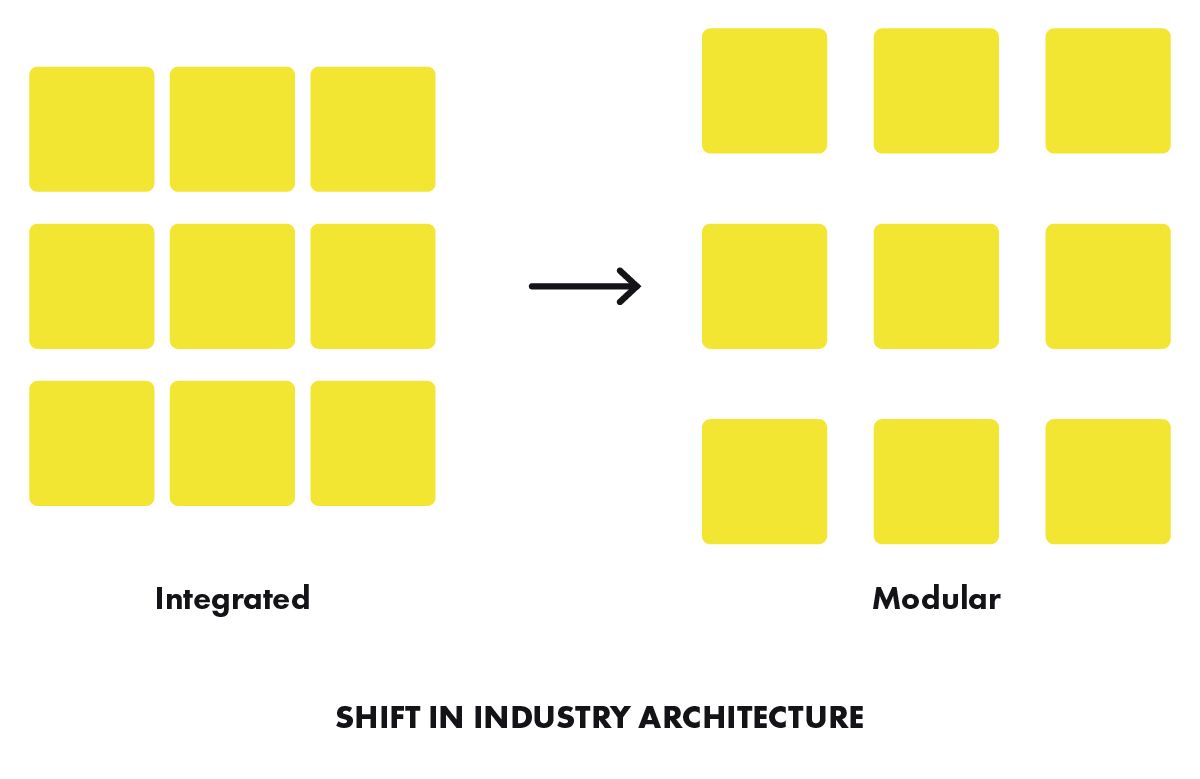

As traditional industries like healthcare transform to platform-enabled ecosystems, incumbent firms need to better understand this shift in an industry’s architecture and its resultant impact on the incumbent firms’ ability to capture value.

The rise of ecosystems: a shift in industry architecture

Ecosystemic organization of activities across an industry value chain.

Through most of the twentieth century, businesses scaled through vertical integration, integrating multiple activities across supply, production, and distribution. This offered greater control across value chain activities. It also minimized the transaction costs that emerge in inter-firm coordination.

Transaction costs determine an industry’s structure -- the manner in which firms organize themselves and interact with other players. To minimize transaction costs, most firms engaged in vertical integration. Most industries, accordingly, took on a vertical architecture with a few large vertically integrated firms competing with each other.

Digitization of activities across an industry value chain fundamentally changes this vertical industry architecture and enables the rise of multi-sided platforms to reconfigure the organization of value chain activities. Digitization reconfigures firm boundaries and scope, enabling a more modular industry architecture, where value chain activities may be orchestrated by multi-sided platforms.

First, digital technologies enable increased data generation, aggregation and analysis, reducing transaction costs and enabling firms to more effectively coordinate without requiring vertical integration.

Second, digitization reduces asset-specificity and increases interoperability as digital assets are reprogrammable and repurposable and hence, more fungible. A key factor driving vertical integration was the increased lock-in -- and renegotiation risks -- created by relation-specific assets. Increased fungibility of digital assets also opens up new opportunities for innovation. Using application programming interfaces (APIs), firms can effectively open up information assets and services to external stakeholders, enabling inter-firm coordination and open innovation.

Third, connectivity and digitization change the way resources and actors may be identified and monitored. This changes the nature of control, further impacting the scope of the firm. Control may be exercised over resources and actors without requiring explicit ownership or traditional employment relationships. As a result, asset-light firms, which specialize in data aggregation and analysis, gain greater power in the value chain and to coordinate activities that lie outside their firm boundaries.

Finally, digital technologies also enable greater value creation through complements. This enables firms to more easily co-create value with creators of complements. For example, mobile applications act as complements to a smartphone’s operating system, increasing the scope of the phone’s functionality. Similarly, cloud-hosted software programs like Slack, the enterprise chat software, and Zoom, the video communication tool, interoperate with a wide variety of applications using APIs, thereby enabling a large scope of functionalities for consumers.

As a result of these factors, the links in the vertically integrated value chain start to break up and new specialized competitors emerge that are more agile and innovative in delivering a specific task in the value chain. The vertically integrated industry architecture increasingly gives way to a more modular ‘layered’ ecosystem where firms at every layer specialize in a particular value creating activity.

In these modular ecosystems, firms specialize and increasingly retain those activities where they possess superior capabilities. This has a positive reinforcement on the evolution of firm capabilities as they increasingly specialize in the activities they retain, while weakening capabilities in the activities they let go of. This further drives firm specialization and increases modularity.

The adoption of APIs for inter-firm coordination further drives this modularity. With more business processes being managed through cloud-hosted services, APIs enable process modularity and communication across business processes, and eventually across firms along the value chain. APIs change the nature of inter-firm collaboration and allow superior coordination, further reinforcing this modularity.

Greater adoption of modular technology coupled with increased firm specialization reinforces the shift to a more modular industry architecture and allows firms to increasingly become more innovative at their specialized activities.

However, increasing modularity also leads to higher coordination costs, limiting the gains from specialization. Moreover, while digitization reduces many forms of transaction costs, certain transaction costs - particularly those related to safety, quality, and property rights - increase and may require new forms of governance and mediation.

These coordination costs may be resolved through two mechanisms: promoting open standards and setting up proprietary platforms.

Open standards: In certain parts of the value chain, firms may need to engage in collective self- governance by setting up open standards. Standards are specifications that determine the compatibility of different technological components. Standards increase the ability of firms building these components to coordinate their activities, leading to greater coordination across the value chain.

The adoption of a common standard by all market participants increases the availability of other complements. This creates a network effect where greater usage of the standard is strengthened by the availability of more complements and superior inter-firm coordination as a result, driving further adoption of the standard. This eventually leads to winner-take-all outcomes where a single standard may dominate.

Proprietary platforms: A platform is a business based on enabling value-creating interactions between external producers and consumers. To facilitate inter-firm coordination, a platform provides an open, participative infrastructure for these interactions and sets governance conditions for them. Platforms generate value by reducing transaction costs and coordinating diverse external actors. They also benefit from network effects, particularly indirect network effects, where greater participation by producers of complements increases the platform’s value for consumers and vice versa.

Platform firms own key control points or competitive bottlenecks which other ecosystem firms need to access. The ownership of these control points provides strategic leverage to the platform firm. Firms may engage across a spectrum of openness at different parts of the value chain, combining open standards with proprietary platform strategies. The mix of strategic choices is driven by the trade-off between value creation (encouraged through openness) and value capture (managed by setting up control points).

Ecosystemic organization of the healthcare industry

Increasing modularity across the healthcare value chain coupled with falling coordination costs are driving the shift of the industry towards ecosystem-based organization of activities.

Care delivery is increasingly becoming modular, as it is unbundled from traditional care facilities. The proliferation of sensor-enabled wearables has driven the rise of self-assessment by consumers and remote monitoring of patients by providers, unbundling care from traditional facilities. Urgent care clinics, retail medicine, and telehealth, have also created new models of care delivery.

Producers - healthcare providers, pharmaceutical manufacturers, and healthcare device manufacturers - are increasingly adopting cloud-hosted infrastructure to manage their business processes.

The unbundling of healthcare delivery from traditional institutions and the shift of healthcare production to cloud-hosted infrastructure are driving greater modularity in healthcare consumption and production respectively.

While modularity of healthcare delivery increases consumer choice, the lack of data interoperability creates a fragmented patient journey, as patients cannot easily port their data from one provider to another, or integrate data from wearables with their data. Despite greater consumer choice, the coordination costs to drive end-to-end patient care increase. Electronic Health Records (EHRs) were originally set up with the goal of achieving data portability across health systems. But, EHR providers evolved their formats independent of each other, increasing data silos.

However, two key shifts -- increasing data interoperability and improvements in AI and machine learning -- are driving down coordination costs, leading to the rise of ecosystems in healthcare.

The first shift - increasing data interoperability - is being driven through the adoption of FHIRs or (Faster Healthcare Interoperability Resources), which create standards for data exchange, allowing developers to build APIs to access datasets across different systems. FHIRs allow sharing of specific pieces of information, such as symptoms, procedures or diagnoses, without passing along entire documents, which further increases modularity as well.

The second shift -- improvements in artificial intelligence (AI) and machine learning (ML) -- reduces coordination costs and changes the economics of healthcare production and delivery.

AI and ML play two key roles in healthcare. First, ML models that analyze structured data -- imaging, genetic, EMR data etc. -- may be employed to study patient populations or perform diagnosis for specific patients. Second, natural language processing (NLP) techniques process unstructured data -- clinical notes, voice recordings etc. -- to create machine-readable, structured data. This structured data can then be analyzed using ML.

Advances in AI and ML commoditize prediction. With growing data interoperability and accessibility, predictions become more accurate as well as more applicable across a wider scope of diseases. This reduces the cost of medical diagnosis, which can now be increasingly performed by machines. This, in turn, makes it feasible to perform diagnosis more frequently and easily, and also unbundles diagnosis from traditional care providers.

This enables an increasing number of diagnoses to be performed as ongoing self-assessments, aiding disease management outside the care facility. Doctors and radiologists can now spend less time diagnosing, and make more granular judgments on the appropriate intervention on the basis of these diagnoses.

Next, the ability to extract data from unstructured notes and voice records reduces operational overhead at the hospital. A home-based voice assistant can better capture patient data without requiring the patient to visit a care facility.

By commoditizing data capture assessment, and diagnosis, the frequency of these activities may be increased, while also unbundling them from in-facility patient interactions.

Effectively, improvements in AI and machine learning, coupled with increasing data interoperability, further increase modularity in healthcare production and consumption and also reduce coordination costs.

Infrastructure strategies in healthcare ecosystems

Google and Amazon already serve many healthcare clients on their cloud infrastructure. Google provides clinical and operational infrastructure that underpins production across healthcare operations, diagnostics, drug R&D, surgery, and claims management. This combines a HIPAA-compliant Google Cloud with the Google Healthcare API, enabling healthcare providers to store and aggregate data across multiple sources. Further, Google’s DeepMind enables access to diverse, siloed data in a standardized format, enabling a wider scope of data elements to be analyzed for clinical decision making. Google’s infrastructure also includes capabilities like DeepVariant, which provides an open-source deep learning tool for genomic analysis, aimed at the life sciences industry.

Google also bundles key complements to its data management infrastructure, which extend its coordination infrastructure across the healthcare ecosystem. These complements include:

1: Complementary datasets: Research programs run by Google collect health data from participants and store these datasets in Google Cloud. These datasets may eventually be accessible to researchers using the platform.

2: Diagnostic services that aid clinical decision making: DeepMind’s Streams app, a complement to Google’s infrastructure, detects acute kidney injuries by analyzing diverse datasets on Google Cloud.

3: Robotic surgery capabilities: Verb Surgical, co-created by Google’s Verily and Johnson-and- Johnson, is building robotic surgery complements to Google’s infrastructure.

4: Data capture tools: Google’s MedicalDigitalAssist uses speech recognition to transcribe conversations and extract notes by recognizing medical terminology. Google’s Study Watch is another important data-capture complement to its infrastructure and may be deployed to volunteers in clinical studies.

Unlike Google’s AI focus, Amazon’s infrastructure play is more focused on healthcare operations and on computation-intensive research. Using its existing strengths in supply chain management software, Amazon is likely to provide pharmaceutical logistics management capabilities as part of its infrastructure. Amazon’s acquisition of GRAIL indicates that Genomics -- which requires computation-intensive analysis -- is a focus area for its infrastructure strategy.

Similar to Google, Amazon (AWS), bundles complements to its infrastructure, including:

1: Data mining capabilities to extract datasets: Amazon Comprehend Medical analyzes EHRs to extract data and store it in AWS. Amazon Transcribe Medical transcribes medical speech in primary care settings.

2: Datasets: Amazon’s acquisition of GRAIL provides complementary datasets and analysis tools for genome sequencing.

By bundling these complements, Google and Amazon strengthen their respective value propositions as healthcare infrastructure.

Aggregation strategies in healthcare ecosystems

Apple’s Health Record aims to be the central health record for users, combining data from acute care -- currently stored in EHRs -- with data from a variety of wellness and disease management devices and services, using FHIR-based integration. Apple’s partnerships with health systems and EHR vendors enable it to integrate EHR data with the Health Record. Apple also partners with Health Gorilla, a clinical data API exchange, to integrate diagnostic data.

Apple’s Health Record acts as a key control point attracting five diverse communities of producers looking to access these consumers -- developers, device manufacturers, healthcare providers, pharma companies and medical researchers.

First, Apple provides access to its health record API to third parties through a software development kit called HealthKit. Every app connecting to HealthKit may access data from the Personal Health Record. Prominent device manufacturers, like Nike and Jawbone, use the HealthKit API to integrate their devices as complements to the Personal Health Record. Next, Apple’s CareKit enables care providers to develop apps that monitor patients across the care pathway, particularly to manage chronic diseases. Finally, Apple’s ResearchKit enables medical researchers and pharma companies to conduct studies leveraging the iPhone’s user base. Apple makes it easier to identify, target, and recruit eligible candidates for a research study, based on their health record data.

The Apple Watch Series 6 includes an electrocardiogram and a blood oxygen monitor. Medical device complements may include diagnostic tools that physically connect to the iPhone or integrate with the Apple Watch.

Google’s research experiments with the Study Watch indicate that it is likely to use connected wearables to assess, diagnose, and manage diseases. Alphabet’s subsidiary Verily is working on a range of data capture and diagnosis mechanisms to enable a superior condition assessment, diagnosis, and disease management experience. Verily’s Study Watch -- a sensor-based wearable device for non-invasive, continuous monitoring -- plays a strategic role in data capture and monitoring of several health conditions, by collecting ‘biometric health information’. For instance, the Study Watch includes an electrocardiogram (ECG) and a heart rate monitor, which may be used to help detect cardiac issues and better predict heart episodes.

The Study Watch also captures environmental data, and could alert patients regarding environmental conditions that could trigger chronic lower respiratory disease.Verily’s Personalized Parkinson’s Project combines data from the Study Watch with clinical data to identify the onset of Parkinson’s Disease.

Google’s data capture tools -- MedicalDigitalAssist and Suki -- may help Google move into mediating doctor-patient interactions. Google’s investments in Ready -- an on-demand network of paramedics and nurses -- and Amwell -- a telehealth operator -- provide some of the assets which could be integrated with MedicalDigitailAssist and Suki, to enable doctors to remotely serve patients while also capturing notes and managing documentation for these interactions more effectively.

Amazon’s ecommerce leadership affords it a natural aggregation play, especially with the acquisition of Pillpack. Amazon’s wearable Halo captures a variety of healthcare indicators using 3D body scans and voice tone analysis. Amazon Alexa developed software that would meet HIPAA regulations. After gaining HIPAA compliance, Amazon also onboarded six business partners to bundle complementary Alexa Skills for the healthcare industry. These skills allow consumers to make appointments, access medical instructions, or track a prescription, among other things.

Open standards development in healthcare ecosystems

Open standards development may help change the competitive dynamics in an industry by commoditizing incumbent advantages. While traditional firms, particularly EHR vendors, resist interoperability in healthcare, platform firms often work together to promote open standards. Google and Amazon have joined efforts to support FHIRs through Project Blue Button, which aims to make it easier for patients to view and download their health records. They are also implementing the standard in their cloud infrastructure and consumer-facing applications. Google’s Cloud Healthcare API provides a solution for storing and accessing healthcare data in FHIR format, while Apple has implemented FHIRs in its consumer- facing Health Records.

Through a combination of open standards and proprietary platforms, these firms work on reducing industry-wide coordination costs, while also setting up control points that make other value chain actors dependent on them.

Conclusion

The shift to ecosystems has transformed the economic organization of many industries. Using healthcare as an example, this article lays out the strategies that platform players pursue when industries move to ecosystemic architecture. During such shifts, incumbents get increasingly commoditized as platform firms manage key decision support for providers (e.g. diagnosis decision support in healthcare) and ongoing consumer relationship management (e.g. remote assessment and disease management for patients in healthcare). In fact, as platform firms expand across the value chain, they may set up competitive bottlenecks that reduce incumbents’ ability to capture value.

Industry incumbents seeking to craft responses to such platform moves must understand the different moves these platforms make in an ecosystem and craft responses accordingly. Some firms may choose to pursue platform strategies of their own. Others may either partner with platforms or engage in collective action through consortia.

While this article illustrates these concepts with examples from the healthcare industry, the strategies and effects detailed here may be applied across industries. Managers in industries which still haven’t been organized as ecosystems should also proactively consider collaborating on common industry infrastructure and user data standards and formats to prevent platform firms from taking those positions in the future. Regulators, in turn, should craft regulation separately for aggregation and infrastructure plays in ecosystems, especially as their market power may be attributable to different factors.

Sangeet paul Choudary is the co-author of the bestselling Platform revolution: How networked markets are transforming the economy and how to make them work for you (2016). He is founder of Platformation Labs (platformthinkinglabs.com), a C-level advisory and executive education firm on platform and ecosystem strategies. The firm has advised senior leadership of more than 35 of the Fortune 500 firms on applying platform strategies in their respective industries, and has worked extensively across the EU, the Americas, Asia- Pacific, and Sub-Saharan Africa.

Resources

Carliss Y. Baldwin and Kim B. Clark, Design Rules: The Power of Modularity, MIT Press, 2000.

José van Dijck, Thomas Poell, Martijn de Waal, The Platform Society: Public Values in a Connective World, Oxford University Press, 2018.

Marco Iansiti and Roy Levien, The Keystone Advantage: What the New Dynamics of Business Ecosystems Mean for Strategy, Innovation, and Sustainability, Harvard Business Press, 2004.

Geoffrey G. Parker, Marshall W. Van Alstyne, and Sangeet Paul Choudary, Platform revolution: How networked markets are transforming the economy and how to make them work for you, W. W. Norton & Company, 2016.

Nicolaj Siggelkow and Christian Terwiesch, Connected Strategy: Building Continuous Customer Relationships for Competitive Advantage, Harvard Business Review Press, 2019.

Jonathan Zittrain, The Future of the Internet, Yale University Press, 2008.